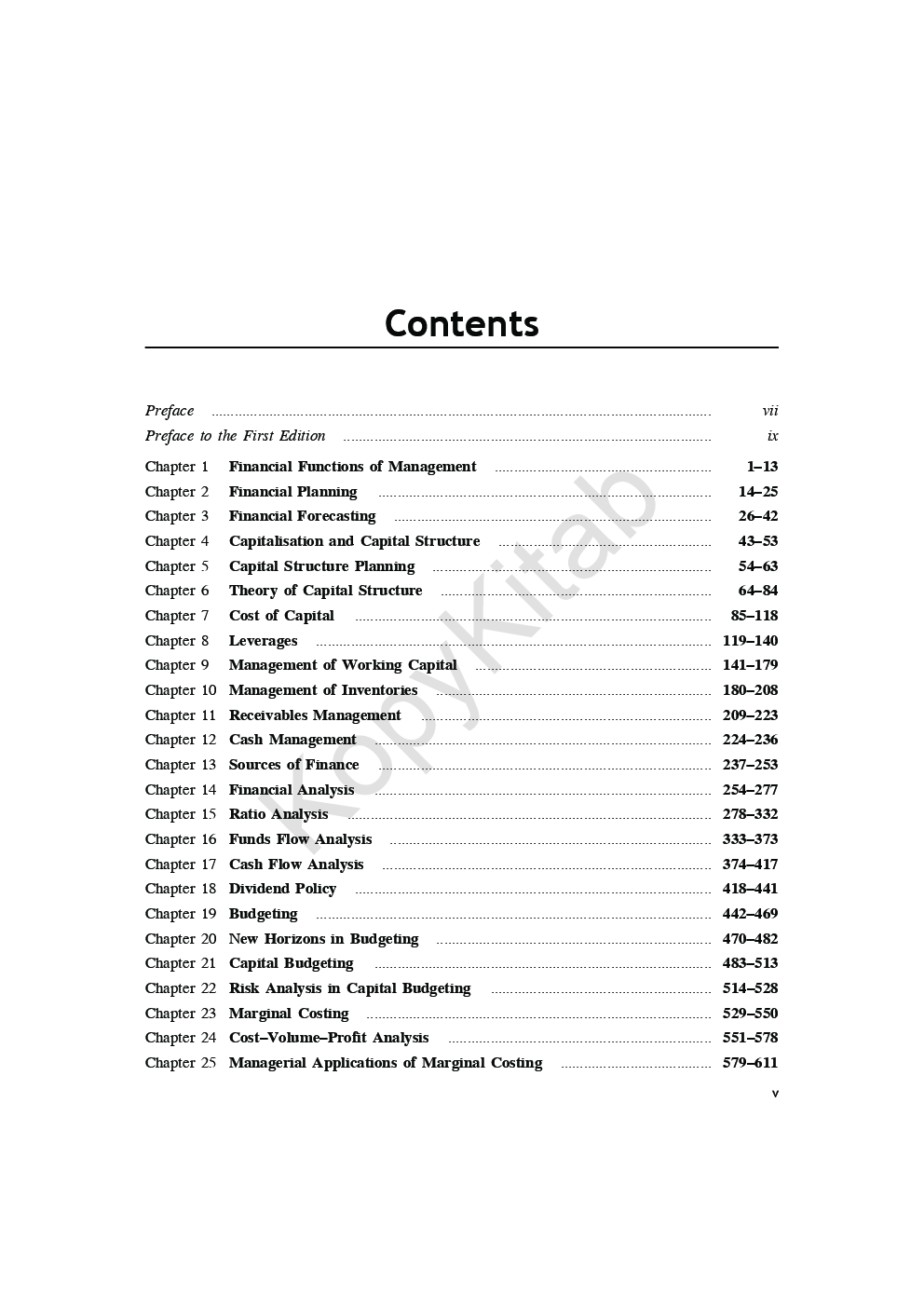

This new edition, expanded with the addition of four new chapters, continues to help students develop an essential understanding of how financial management plays a positive role in strategic management of organizations. The book is designed for a foundation course in financial management for the postgraduate students of business management (MBA), commerce, engineering and technology. It focuses on presenting with great clarity the basic concepts underlying the theory of financial management and also the real-world practice in areas of investment, financing and asset management.

Each financial function is discussed in the most lucid and concise manner to help students improve their basic skills in financial management. The aim of the book is to enable the readers to get a profound insight into the financial decision-making processes. The book introduces the readers to the three major decision-making areas in financial management: break-even analysis, decisions involving alternative choices, and variance analysis.

This book Useful for Management students.

1. Financial Functions of Management

2. Financial Planning

3. Financial Forecasting

4. Capitalisation and Capital Structure

5. Capital Structure Planning

6. Theory of Capital Structure

7. Cost of Capital

8. Leverages

9. Management of Working Capital

10. Management of Inventory

11. Receivables Management

12. Cash Management

13. Sources of Finance

14. Financial Analysis

15. Ratio Analysis

16. Funds Flow Analysis

17. Cash Flow Analysis

18. Dividend Policy

19. Budgeting

20. New Horizons in Budgeting

21. Capital Budgeting

22. Risk Analysis in Capital Budgeting

23. Marginal Costing

24. Cost-Volume-Profit Analysis

25. Managerial Applications of Marginal Costing

26. Standard Costing

27. Human Resource Accounting

28. Lease Financing

Appendix

Glossary

Bibliography

Index