This book develops conceptual understanding of the fundamentals of financial accounting which play a crucial role in laying the foundation of commerce and accountancy courses in general and CPT in particular. Dexterously organized to suit the requirements of CPT aspirants, the text presents a step by step analysis of the basic concepts of accountancy in a comprehensive but in an easy-to-grasp manner.

The text begins with discussing the meaning and scope of accounting and moves on by elaborating on different accounting standards, policies and the procedures followed in accounting. It also discusses ledger, trial balance, cash book and bills of exchange or promissory notes in the subsequent chapters. Apart from discussing the various types of accounts, such as partnership accounts and company accounts, this text explains debentures and inventories in a simple and lucid style.

Specifically meant for the prospective examinees of the Common Proficiency Test (CPT), conducted by the Institute of Chartered Accountants of India (ICAI), this text should also prove valuable to undergraduate students of commerce and management.

This book Useful for Management & Commerce students.

1. Meaning and Scope of Accounting

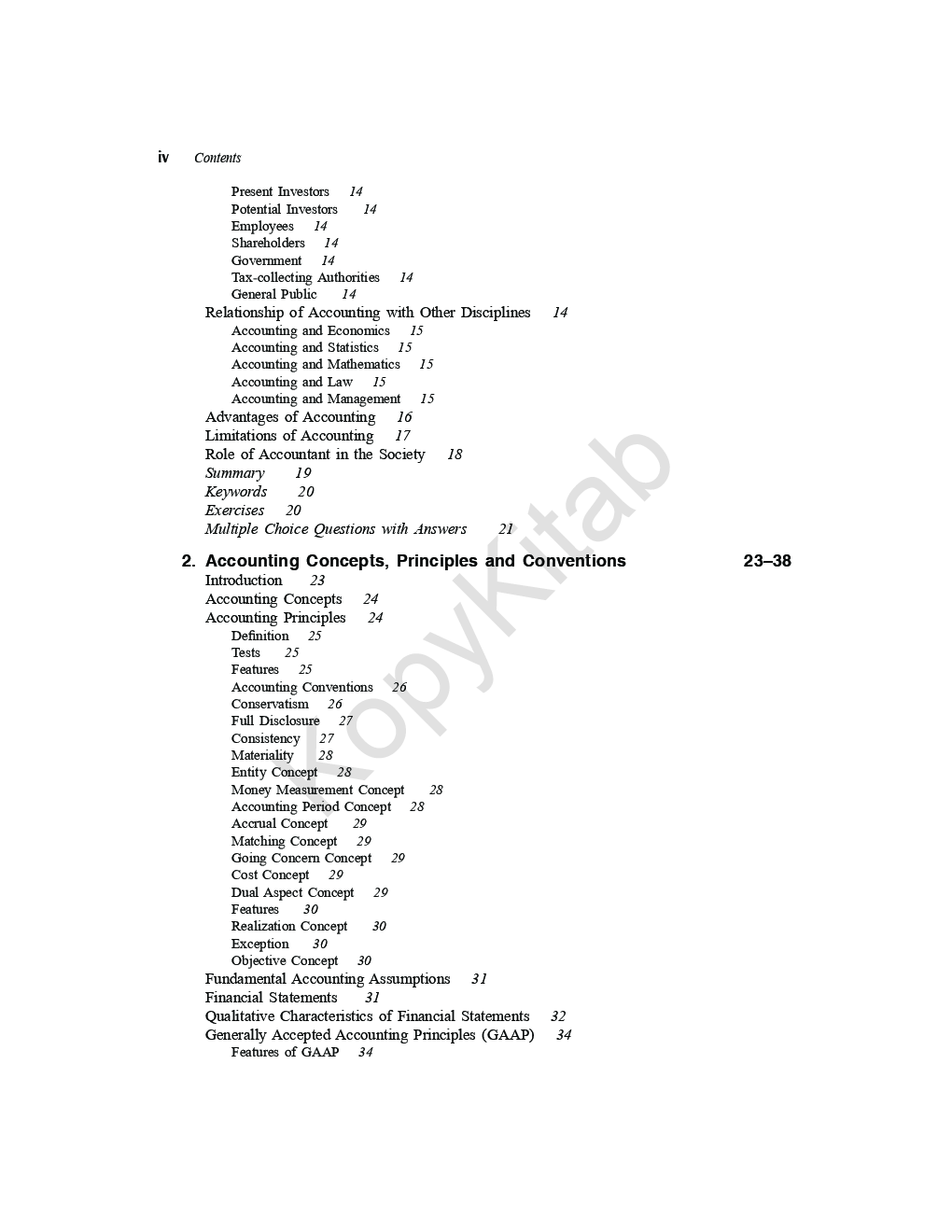

2. Accounting Concepts, Principles and Conventions

3. Accounting Standards: Concepts, Objectives and Benefits

4. Accounting Policies

5. Accounting as a Measurement Discipline: Valuation Principles, Accounting Estimates.

6. Basic Accounting Procedures

7. Ledgers

8. Trial Balance

9. Subsidiary Books

10. Cash Book

11. Capital and Revenue Expenditures and Receipts

12. Contingent Assets and Contingent Liabilities

13. Rectification of Errors

14. Bank Reconciliation Statement

15. Inventories

16. Depreciation Accounting

17. Final Accounts of Non-manufacturing Entities

18. Final Accounts of Manufacturing Entities

19. Consignment

20. Joint Ventures

21. Bill of Exchange and Promissory Notes

22. Sale of Goods on Approval or Return Basis

23. Introduction to Partnership Accounts

24. Treatment of Goodwill in Partnership Accounts

25. Admission of New Partner

26. Retirement of a Partner

27. Death of Partner

28. Introduction to Company Accounts

29. Redemption of Preference Shares

30. Issue of Debentures

Index